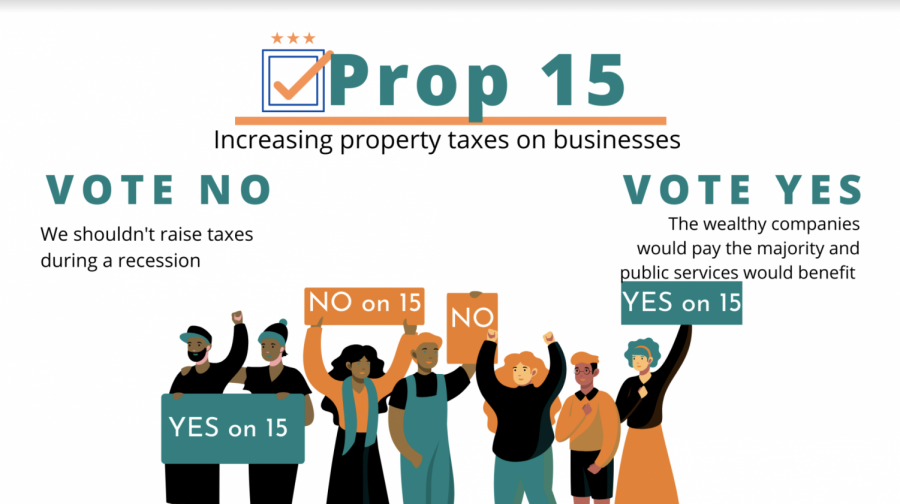

Prop 15: Increasing Property Taxes on Businesses

Prop 15 increases funding for public schools, community colleges, and local government services.

November 1, 2020

OVERVIEW

Prop 15 proposes to tax commercial and industrial properties based off of market value. Right now, properties are taxed by their purchase prices, which is the amount they sold for when bought. Each year, purchase prices increase by either the rate of inflation or 2%, depending on which is lower.

In contrast, market value is calculated based on how much a company or business is worth at any present time. However, properties for commercial agriculture, small businesses, and residential areas would remain taxed by purchase price in Prop 15.

To be exempt from Prop 15 means a property must have either less than or equal to 30 million dollars or be a small business. Small businesses are independently owned and operated, have less than 50 employees, and own California property as well.

If passed, Prop 15 is estimated to bring in around $8 to $12.5 billion. The money is planned to be distributed as follows:

- The majority goes to fill up state revenue gaps and pay for the cost of implementing the measure in counties.

- 60% of what remains goes to local government and special district funding. The other 40% goes to education.

- 89% goes to public and charter schools and county education offices. The other 11% goes to community colleges.

- Schools will also receive an annual amount of $100 per each full-time student.

PROS

Because Prop 15 values properties at market value, it can better adjust to inflation than property price. For example, in the last 20 years, San Francisco’s average rate of inflation is 2.58%. If properties only increased by the lesser amount of 2% each year, that means that the rate is 11.6% less than inflation today.

While businesses save costs through this method, the government has to make up for the deficit, weakening California’s economic stability. Proponents for Prop 15 also argue that because small businesses are excluded, only large behomeths like Disney or Wells Fargo will have to contribute more money.

“[Prop 15] will fund essential services such as public schools and public safety, and, most importantly, it will be decided by a vote of the people,” said Governor Gavin Newsom.

The extra money could help relieve the strain caused by wildfire damages, an increased need for COVID-19 unemployment benefits, an increasing rate of homelessness, and more. The majority of affected taxpayers would also be out-of-state or foreign investors and the very wealthy instead of California residents.

CONS

With the onslaught of COVID, non-supporters argue that low sales and the addition of a new tax will only increase pressure on businesses instead of alleviating it.

By targeting investors, Prop 15 could take away the incentive for businesses to settle and create new jobs in California. California’s notoriously high rates of living already act as a deterrent to businesses, non-supporters argue. Prop 15 would rob businesses of the assurance that they would be taxed with the same predictability and stability that homeowners have.

Detractors also argue that the proposed tax increase means increased prices on daily goods for people in California. If Prop 15 is passed, landlords will need to reassess their buildings, causing a tax hike that would hit renters and homeowners. While in the long term Prop 15 will benefit small businesses, many may not survive the toll it takes short-term.

“[It could be] probably four years of intense pain or even, ‘I can’t pay this.’ And then it’s up to the landlord to decide, ’I have a tenant who can’t pay rent; do I want to work with them or terminate their lease? I don’t know how big it is in the grand scheme of Prop. 15, but for these people who will be affected… those are hard conversations,” said real estate attorney Stephen Ledoux.