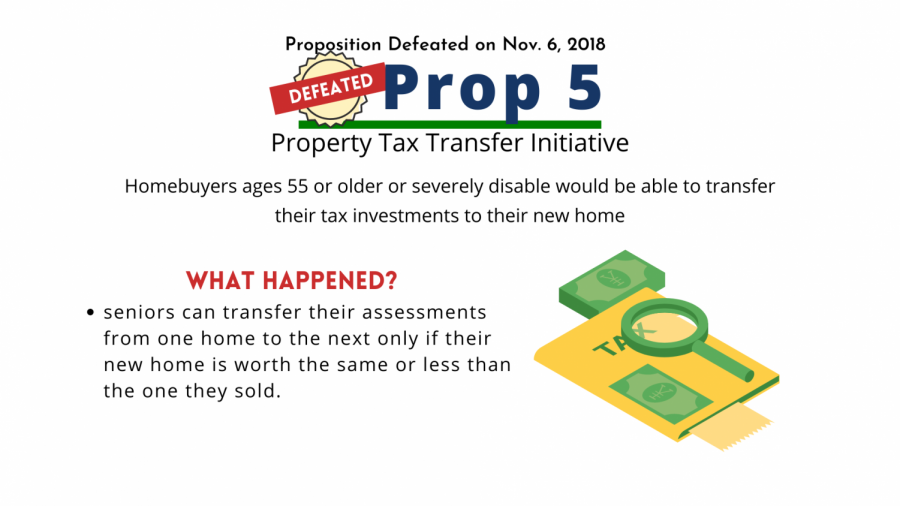

Prop 5: Property tax transfer initiative

Prop 5 aimed to allow seniors to transfer their tax assessments from an old home to a new home.

October 28, 2020

Proposition 5, the ballot proposition that was defeated on November 6th, 2018, argued for homebuyers ages 55 or older or severely disabled to transfer their tax assessments with a possible adjustment from their old home to their new home.

What it does

This proposition would allow these homebuyers to transfer their assessments regardless of the new home’s market value, the new home’s location in the state, and the buyer’s number of moves.

In 1978, Proposition 13, which reduced property tax rates on homes, was passed. Proposition 5, if passed, would have amended this.

Pros

Supporters of this proposition argue that it’s a great way to encourage seniors to move if they wish to do so. Many seniors are hesitant to move because of the possibility of their property taxes increasing drastically.

With this proposition, arguers also believed it would have eliminated the “moving penalty” and brought both peace of mind and tax stability to seniors.

Steve White, president of the California Association of Realtors from ballotpedia stated that “many seniors live in homes that no longer fit their needs because their homes are now too big or too far away from their families. If they want to downsize or move closer to their children, they could face property tax increases of 100 percent, 200 percent or even 300 percent.”

Cons

However, opposers to the proposition argue that it will raise the price of housing, loss of money to public schools and local services, and could provide a huge tax break to wealthy Californians.

More specifically, if a senior were to move into a more expensive home and still keep the same tax rates they previously had on their less-expensive home, they would be saving more money. This is a positive for the senior, but it ultimately affects the places that the extra taxes would’ve helped, including our school community and their expenses.

Asm. David Chiu (D-17) opposes the initiative on ballotpedia, saying that “it doesn’t add housing, and it is going to make it harder for cities and counties to pay for schools, infrastructure, and public safety to the tune of $2 billion per year. We’re in the midst of the most intense housing crisis our state has ever experienced, and this proposal does nothing to address it.”

Voting Results

Proposition 5 was ultimately rejected with the concern that this proposition would’ve led to major revenue loss for schools and local governments.

Currently and until further notice, seniors can transfer their assessments from one home to the next only if their new home is worth the same or less than the one they sold. In addition to this, they can only do this once and it must be in the same county in which they are doing the moving and transfers.