Taking a closer look at Biden’s $1.9 trillion stimulus bill

Biden’s American Rescue Plan Act has short and long-term effects.

March 31, 2021

Following the economic wave of the COVID-19 pandemic, many Americans have fallen on hard times. In response, President Biden signed the $1.9 trillion American Rescue Plan Act on March 11th.

How does this compare to past legislation?

Last March, then-President Trump had signed a bill for stimulus checks under the CARES (Coronavirus Aid, Relief, and Economic Security) act. This stimulus bill provided $1,200 for single adults with an income of less than $75,000 and $2,400 for couples with a combined income of less than $150,000, with children adding an extra $500 to stimulus checks.

The CARES act warranted a positive reaction from most, however many Americans demanded greater checks to keep up with the rising cost of living. Due to this, Congress later passed the Emergency for the People Act, worth $2.2 trillion.

On March 11th, 2021, President Biden signed the $1.9 trillion American Rescue Plan Act, which doubles the funding for local governments from and essentially covers many of the people who fell through the cracks during the last stimulus check, broadening the reach of government support. As the CARES act did not do enough to support struggling Americans, the Biden administration aims to prevent a dramatic increase in poverty through the American Rescue Plan Act.

What are supporters saying?

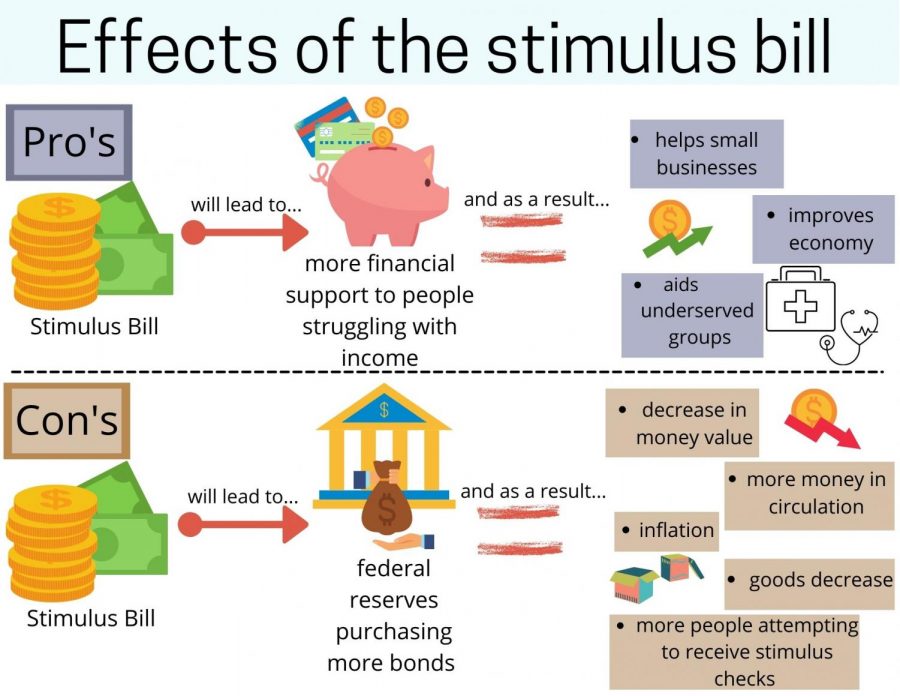

Proponents of this act say that it will provide much more financial support for Americans who have been struggling with lesser to no income with the economic wave of the pandemic.

Another argument for the act is that if people are given a greater, stable source of income they will be able to spend it, therefore, kickstarting the economy for a longer period than before. Keynesian economists support this as it follows the model of a private free economy for the majority of a business cycle, with government support in recessions, because they believe total spending is often unstable and causes recessions.

“It’s been proven that the stimulation of the middle class is a vital part to the economy,” said Hong (‘21).

Proponents also argue that the additional income will be enough to prop up small businesses until the economic downturn of the pandemic ends. Most importantly, the act could enable economically challenged individuals to afford a doctor’s visit, which would significantly reduce the disproportionate effects of COVID-19 on people of different socioeconomic groups.

What are opponents saying?

Opponents of this act say the act will be harmful in the long run. Stimulus checks will be funded by the treasury issuing bonds, essentially IOUs, with the federal reserve purchasing a majority of them.

This risk in this funding will be inflation, as the stimulus checks may lead too much money to be in circulation and too few goods. Businesses will increase the dollar value of products, therefore, devaluing the dollar.

“Keynesian economics doesn’t work in the long run,” said Swaminathan (‘21).

The extra cash may lead landlords and other essential product owners to charge more if price control is not implemented. Another argument is that people may try to stay on low enough incomes to make the cut for stimulus checks, rather than working for a greater income.

“Overall I think that the CARES Act is a necessary piece of legislation to provide aid to a lot of struggling groups that have been affected by the shut down of our economy. I personally see it as emergency relief for these groups (individuals, small businesses, public health, etc.) and not just stimulus, which can sometimes be politicized to increase or decrease support. No legislation is perfect, and at some point I do feel like our country needs to make a real effort to deal with our almost $30 trillion of debt we currently have, but the immediate needs of Americans across the country outweigh any future concerns about the United States deficit spending,” said Economics teacher Robert Palmer.

Regardless of the pros and cons, the stimulus bill is coming, and it will have a significant impact on not only the economy, but also the American people.